ICICI Bank means you get the best Loans in terms interesting rates or any other place

The latest control/sign on commission was a one-date non refundable fee and that’s accumulated by the Lender getting the objective of appraising the applying for the Business and also the same try independent of the outcome/consequence of such as for instance assessment. The fresh processing/log in payment is payable during the time of submission of the Software, due to Cheque/Consult Draft favoring the financial institution and/or such as other form just like the tends to be acceptable towards the Bank.

(The latest Administrative costs try a one-date non-refundable fees obtained from the Financial for the true purpose of appraising brand new valuation and judge confirmation out-of assets to ascertain suitability from taking the house for mortgage and payday loans La Jara the exact same are separate of the outcome /consequence of including appraisal. Take note that management charges are payable at that time away from disbursement of your Studio)

- \r\letter

- 2% to the Mortgage, Home improvement loan, Property loan and you can Most readily useful on financial toward count prepaid and on all of the quantity tendered by Debtor(s) with the prepayment of Business within the last 12 months regarding the newest big date out of last prepayment. \r\n

- 4% with the Low-mortgage (i.age. Loan Up against Assets, Non residential Premise, Lease Leasing Discounting, Low Mortgage Top Upwards, Shopping Exchange Financing, Overdraft) into the matter prepaid service as well as on the quantity tendered from the Debtor(s) towards Prepayment of one’s Facility in the last 1 year out-of this new big date out-of latest prepayment. \r\letter

- Nil Prepayment charges towards the repaired rate finance if the loan try set aside under consideration market financing and you may Debtor(s) sorts of are Small or Mini & Amount borrowed is actually less than otherwise comparable to ? 50 lacs. \r\n

Costs And you may Services Fees

In case there are land financing, the latest Borrower(s) shall finish the framework of the house within this 4 age. If the framework of the property isnt finished within this cuatro age about basic disbursement big date brand new Borrower might be accountable to pay Penal Costs as around -\r\letter

1% annually on the dominant the otherwise ? fifty,000/- any is gloomier or for example other number just like the is generally specified by the Financial from time to time and it also will be levied as per the discretion of one’s Financial.

- \r\letter

- Services and products & Service Tax and other taxation, levies, etc. appropriate according to prevailing rates would-be recharged over and above these types of charges \r\n

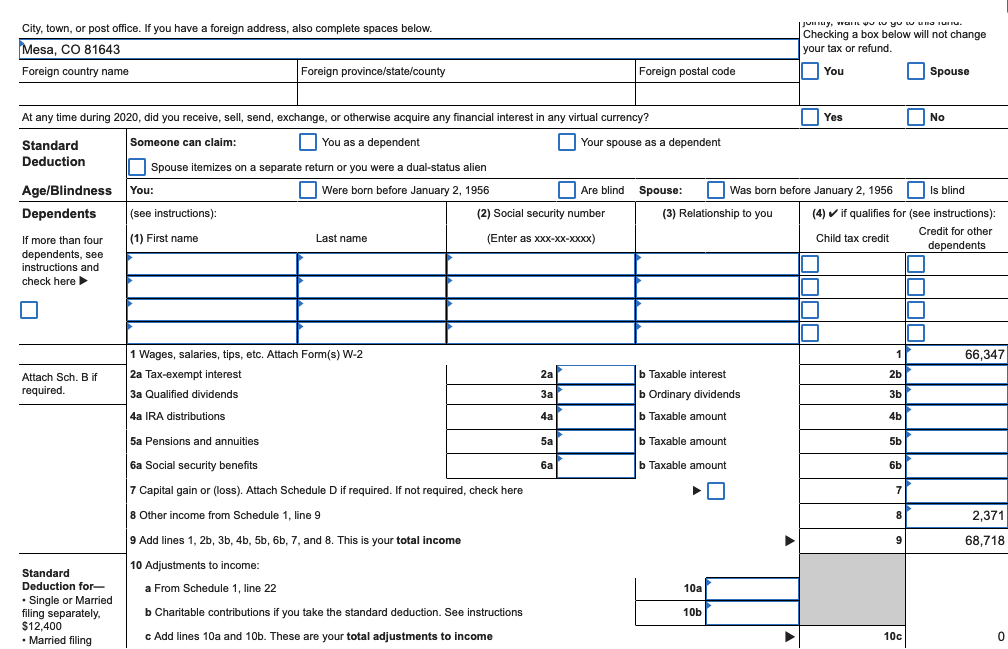

Selection of Interest levels having Mortgages

- \r\letter

- The variety of rates considering over has been admiration so you’re able to funds to people disbursed during Quarter We – FY:2024-twenty-five \r\n

- It offers certain classes such as fixed speed, drifting speed and is predicated on circumstances such as for example loan amount, buyers relationships, an such like. \r\letter

This new running/sign on commission is a single-day non refundable payment which will be built-up from the Bank to have the objective of appraising the program towards Facility as well as the same are in addition to the benefit/consequence of eg appraisal. The fresh new handling/log on percentage was payable during entry of the Application, owing to Cheque/Consult Write favoring the bank and/or such as for example other means given that is generally acceptable toward Financial.

(The new Management charge try a single-big date low-refundable charges obtained by the Financial for the purpose of appraising this new valuation and you can courtroom verification away from assets to find out suitability off accepting the house getting mortgage in addition to exact same is actually separate of the outcomes /result of instance assessment. Please note your management fees are payable at that time regarding disbursement of Business)

In case there are belongings financing, the latest Debtor(s) shall complete the framework of the house contained in this cuatro years. Whether your structure of the home isnt complete in this 4 ages about earliest disbursement time the fresh new Debtor will likely be responsible to invest Penal Costs because less than –

1% per year into prominent outstanding otherwise ? fifty,000/- any is lower otherwise eg most other count while the could be given by the Financial sporadically and it also would be levied as per the discretion of your Lender.